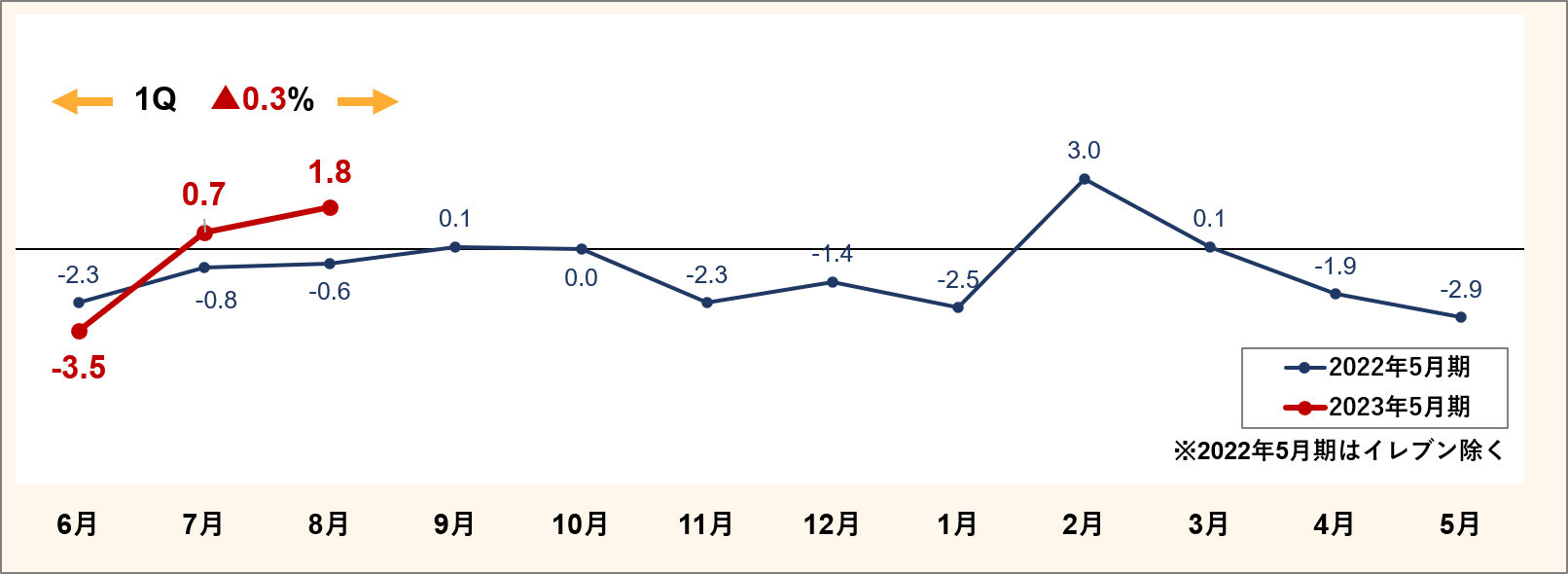

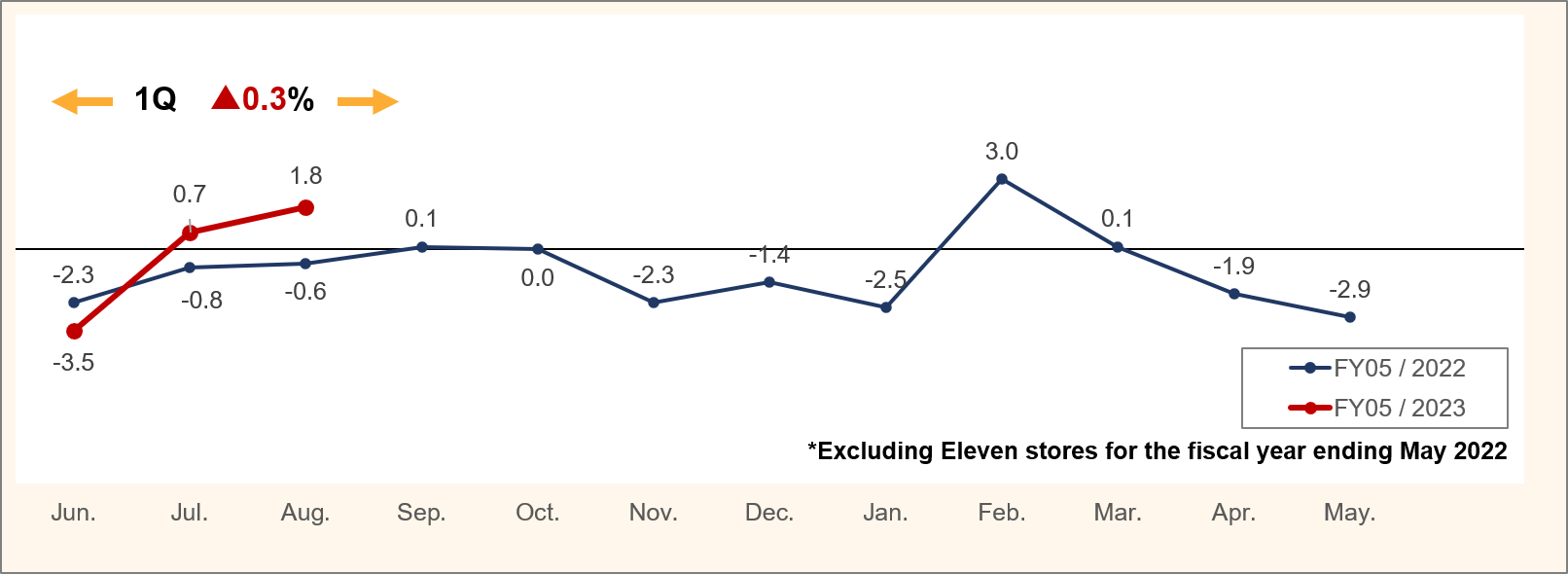

Year-on-YoY change in sales (stores 13 months old)

previous fiscal year

Current term