Index

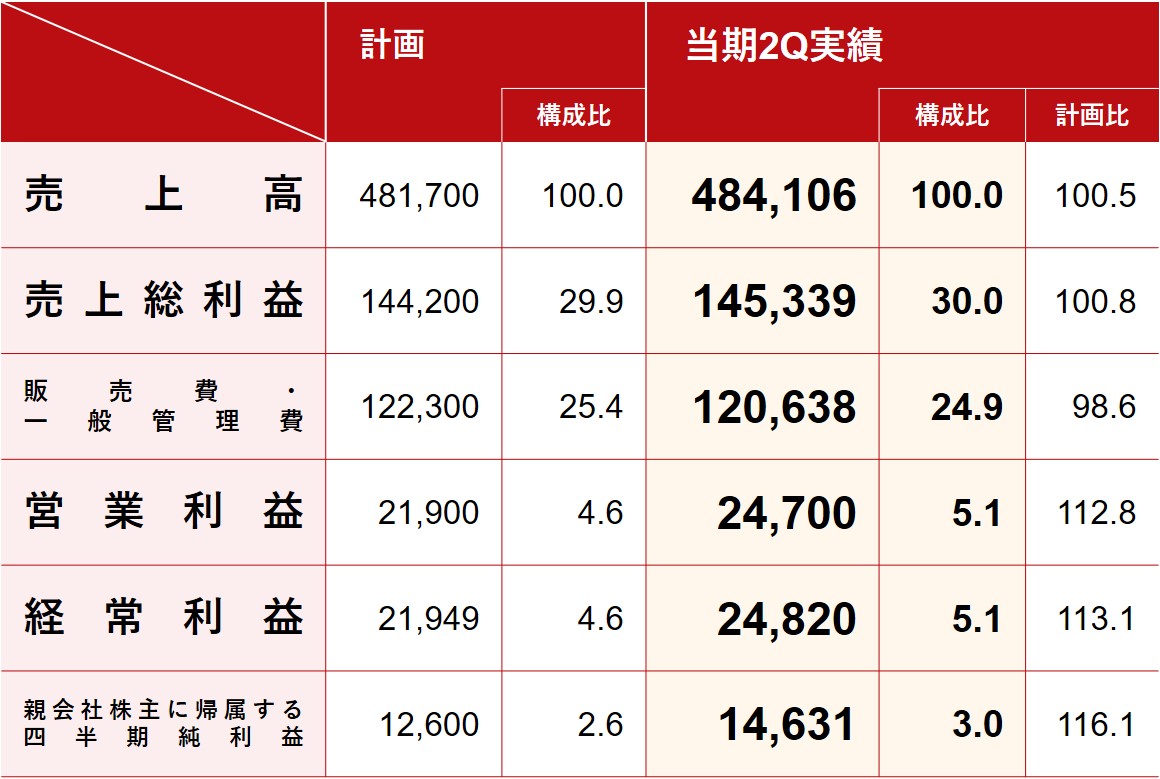

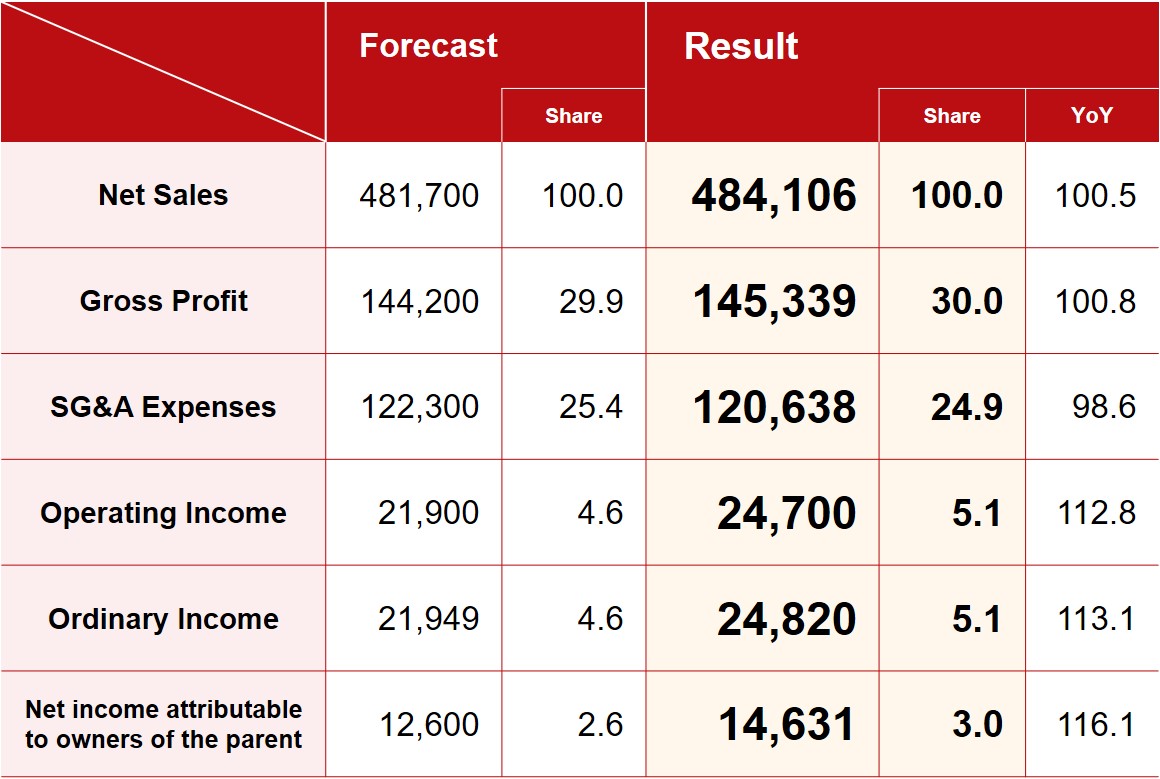

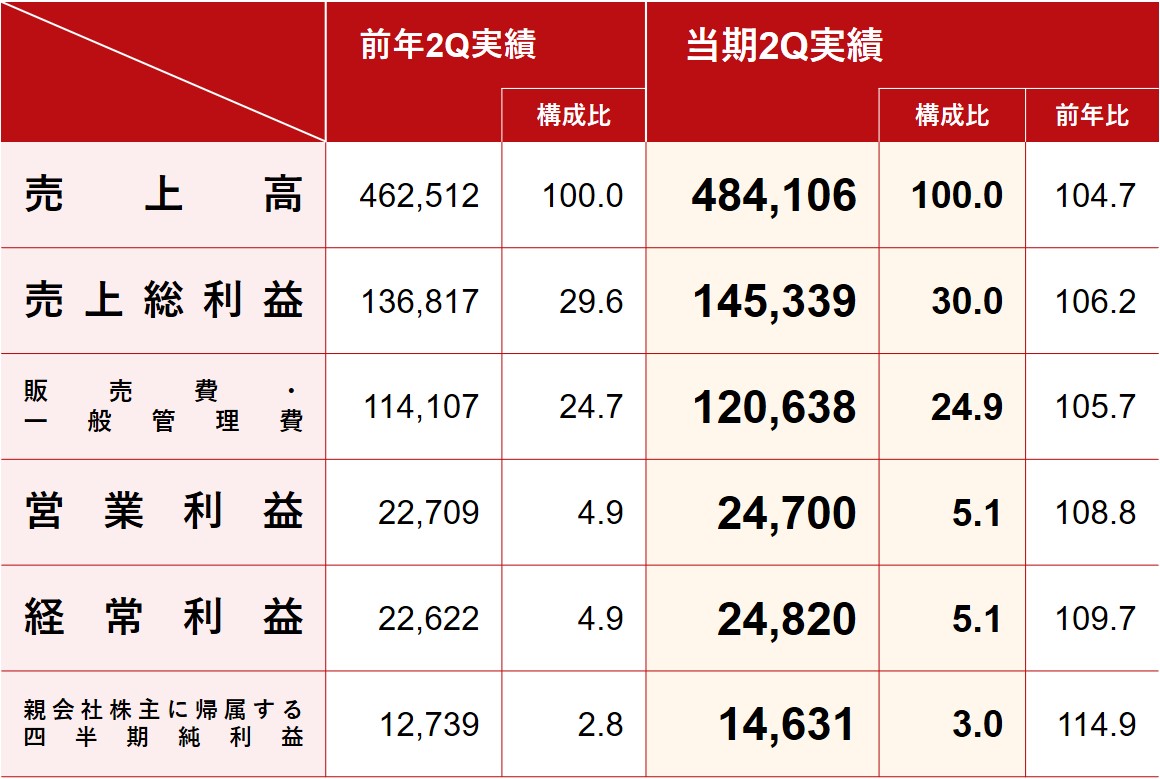

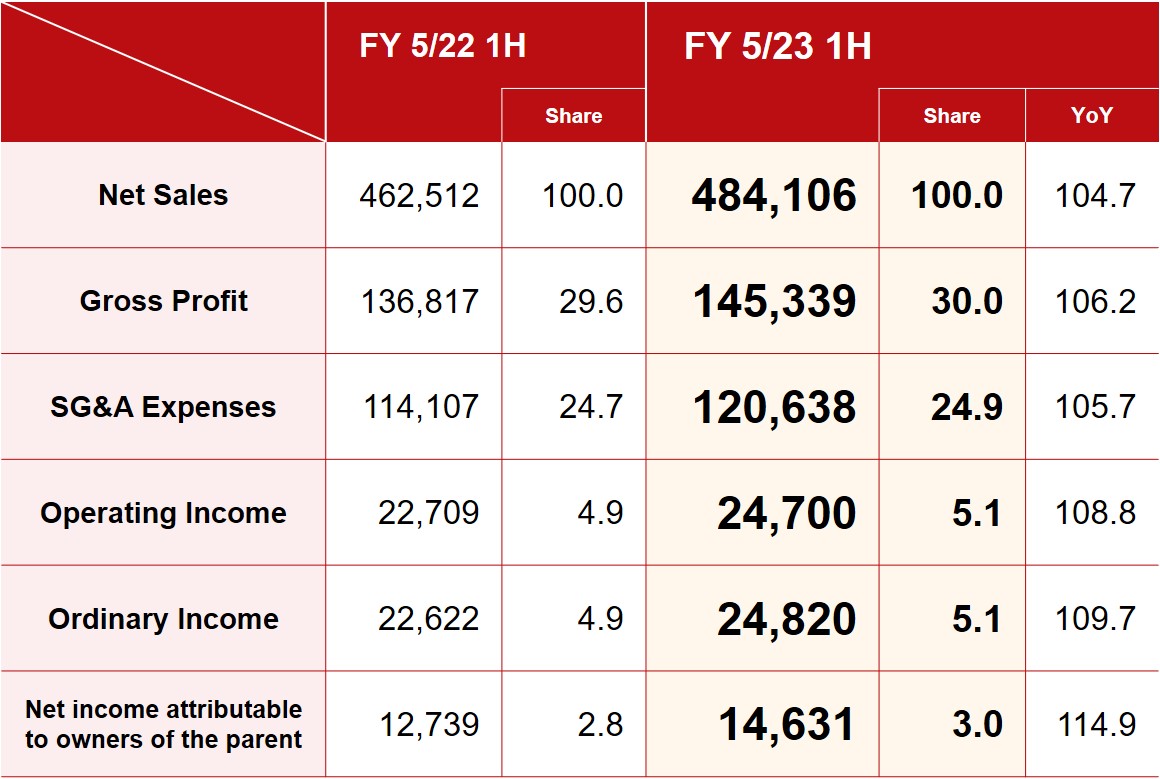

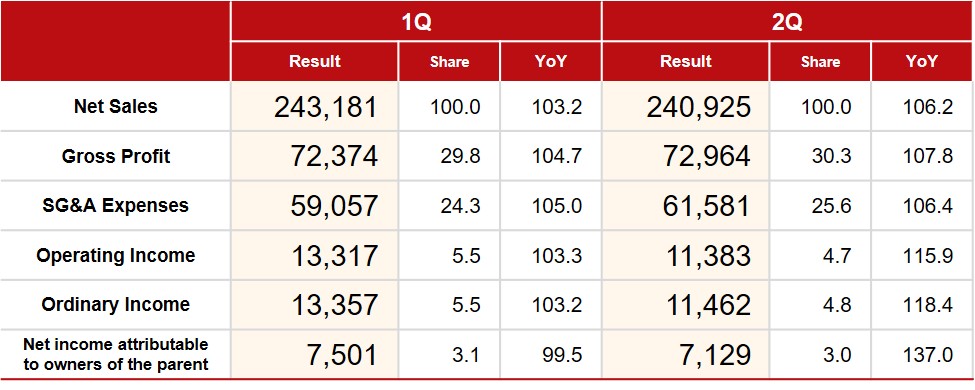

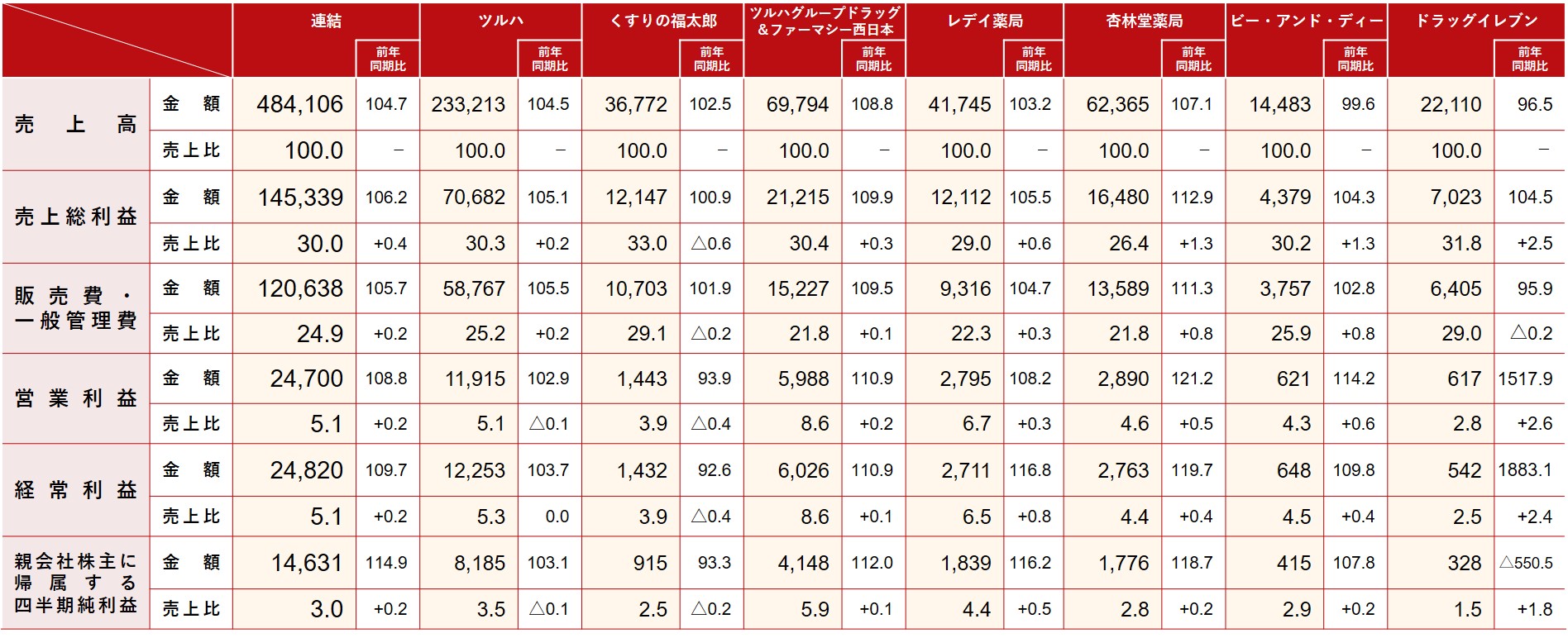

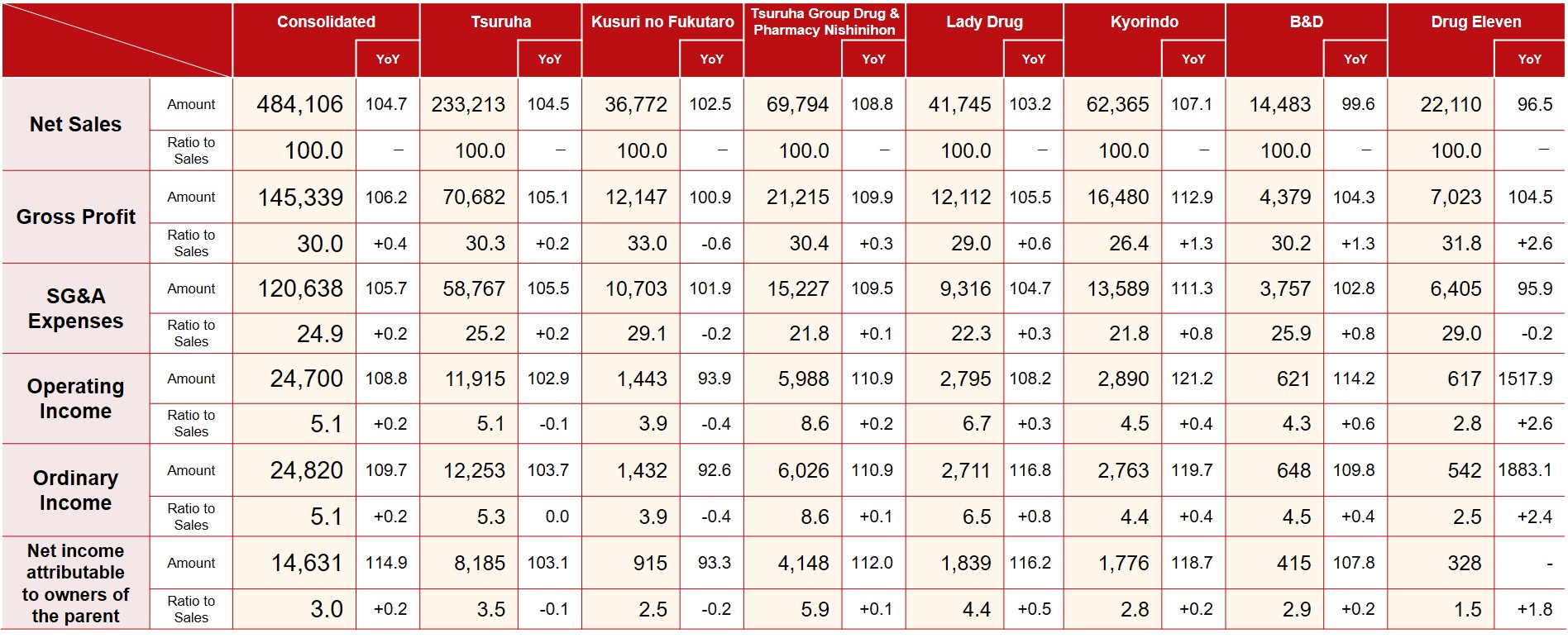

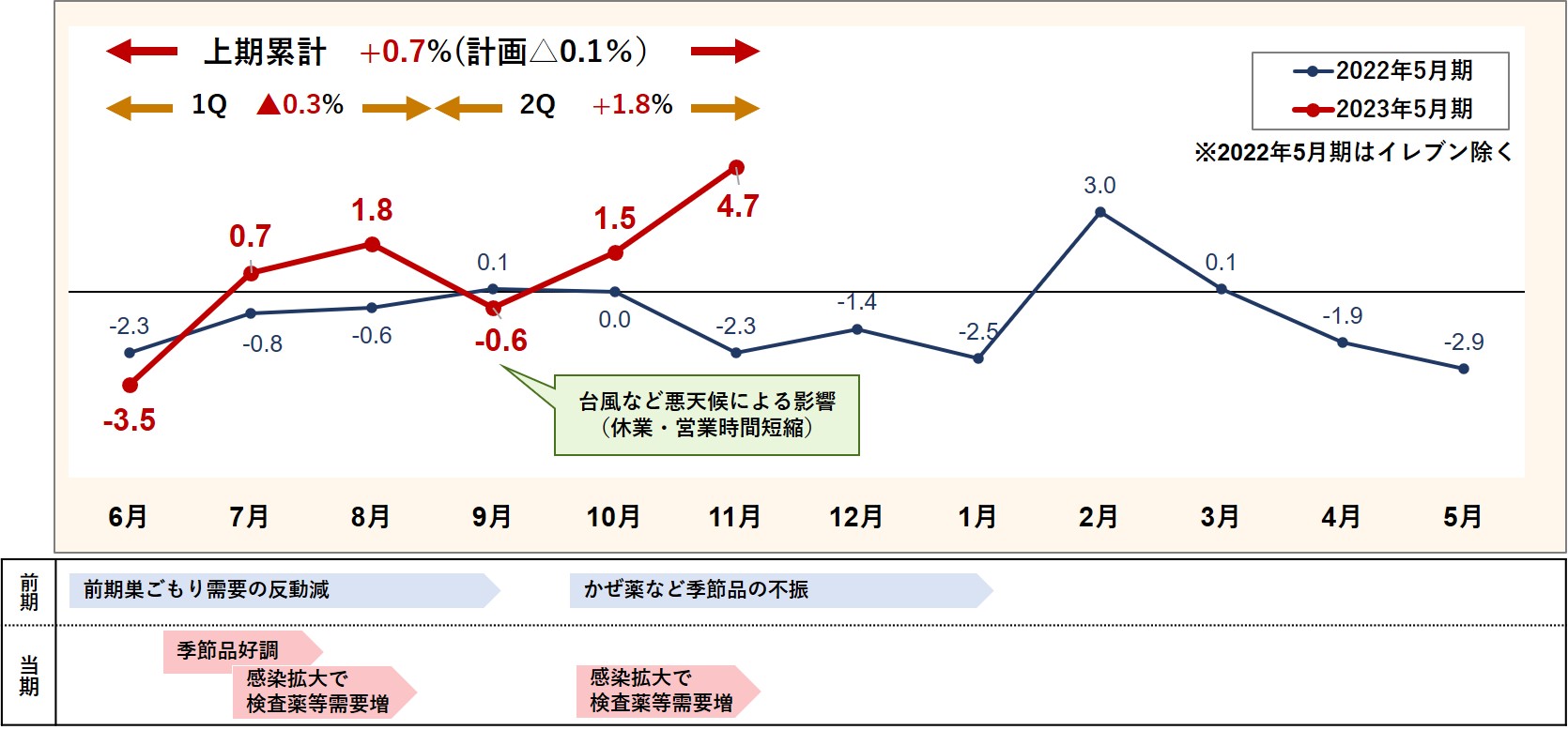

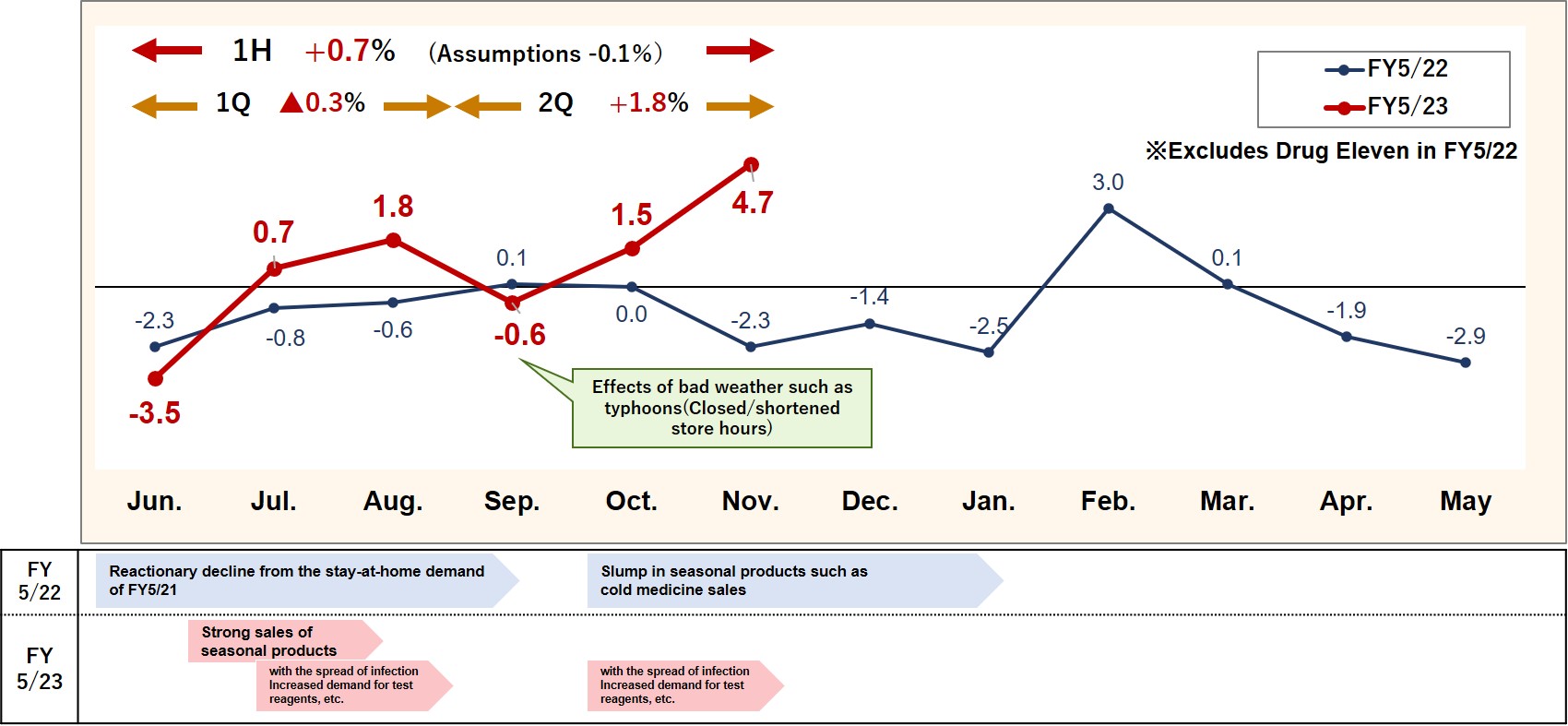

◼ FY05 / 2023 the 2nd quarter results overview ◼ Medium-term management plan and initiatives for FY2020* The following abbreviations may be used in this document.

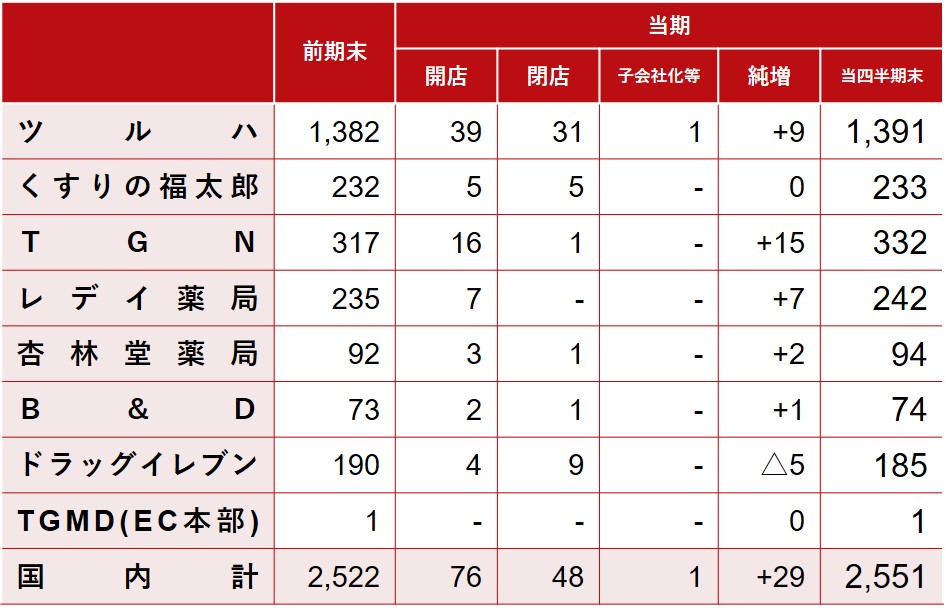

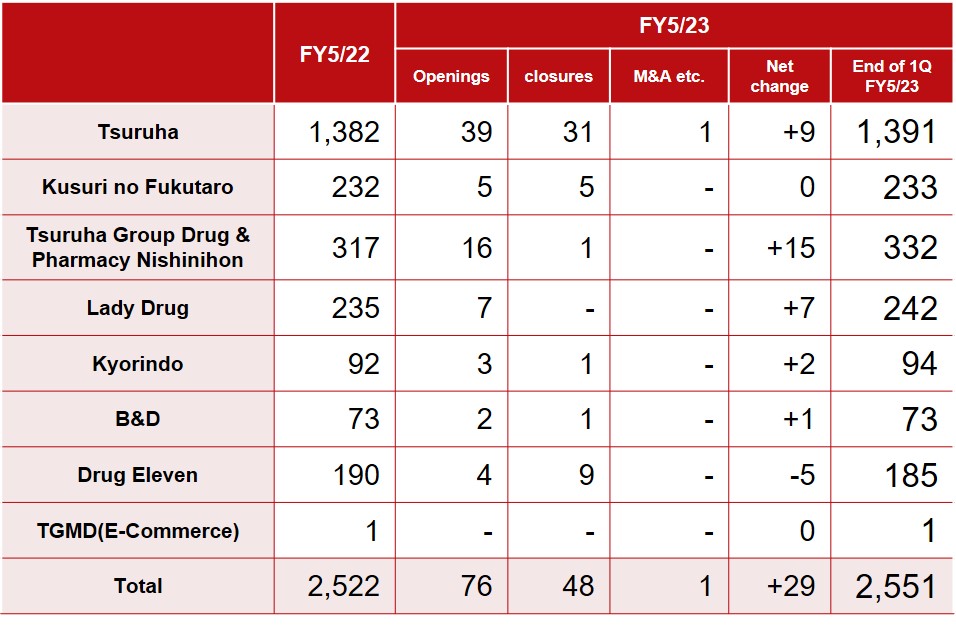

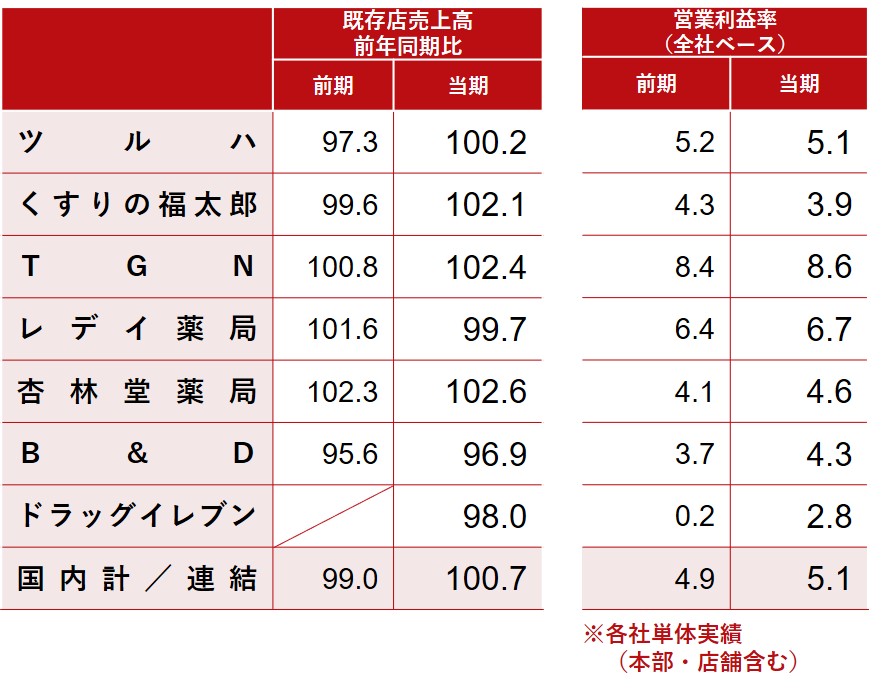

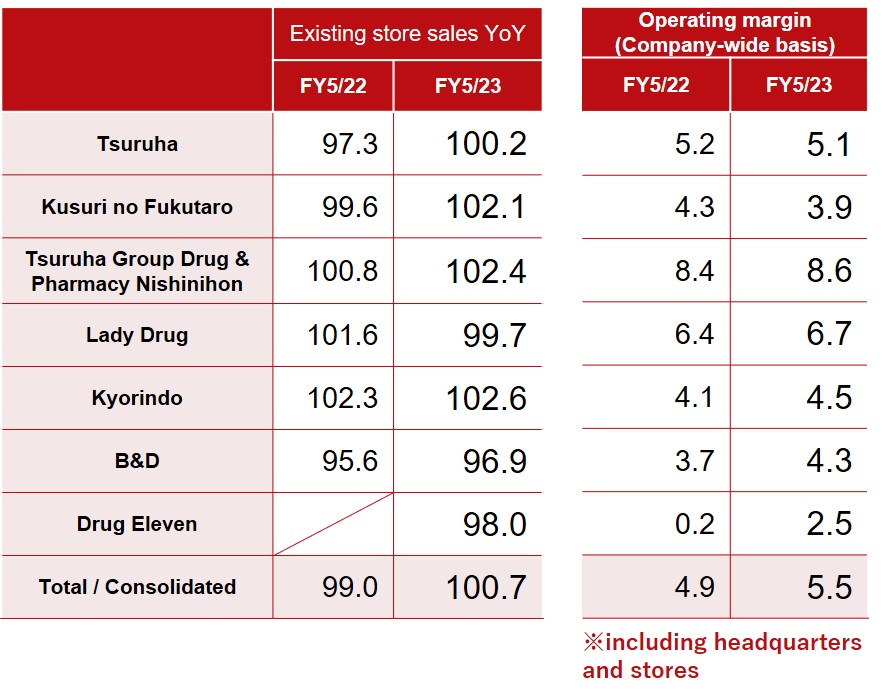

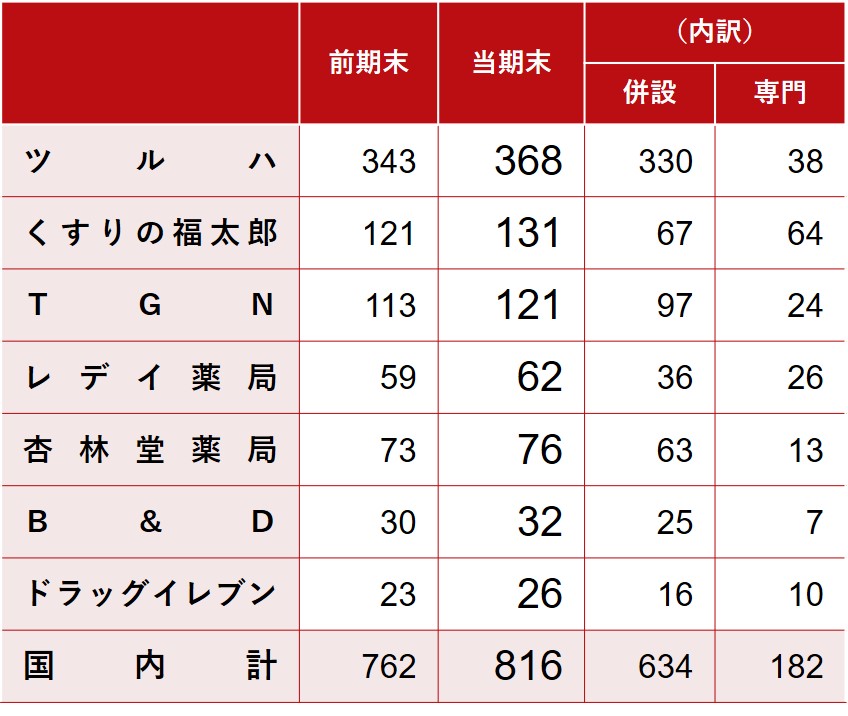

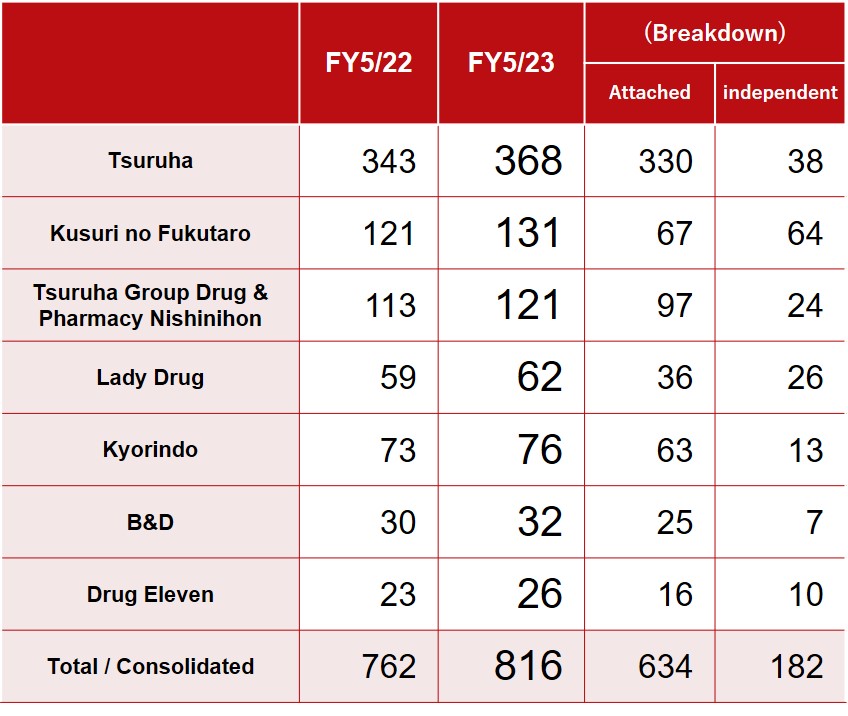

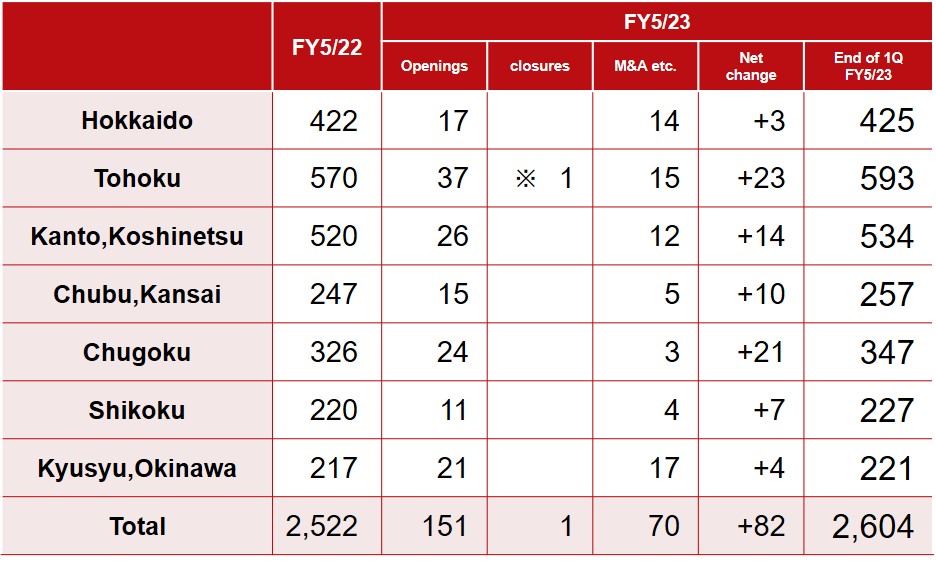

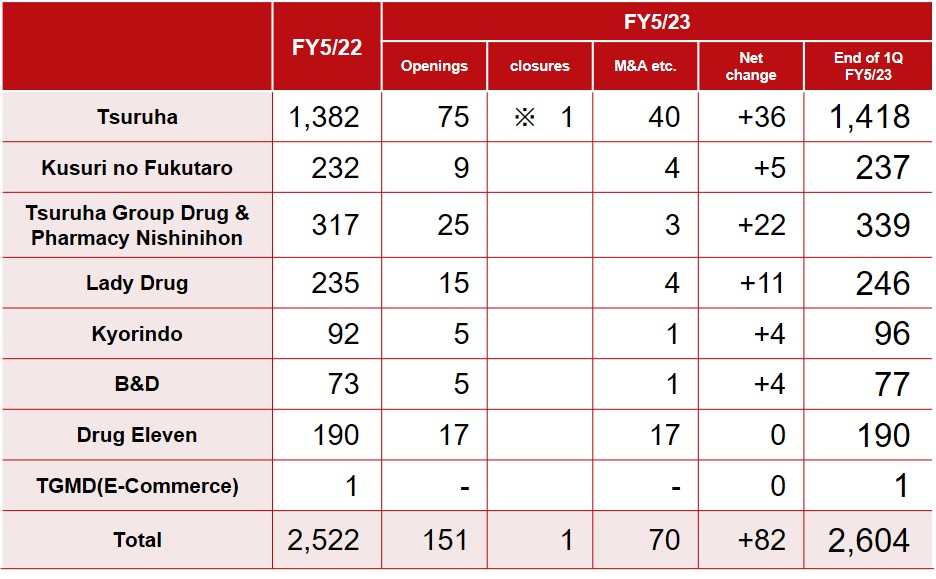

Fukutaro = Kusurino Fukutaro TGN = Tsuruha Group Drug & Pharmacy West Japan Lady = Lady Pharmacy

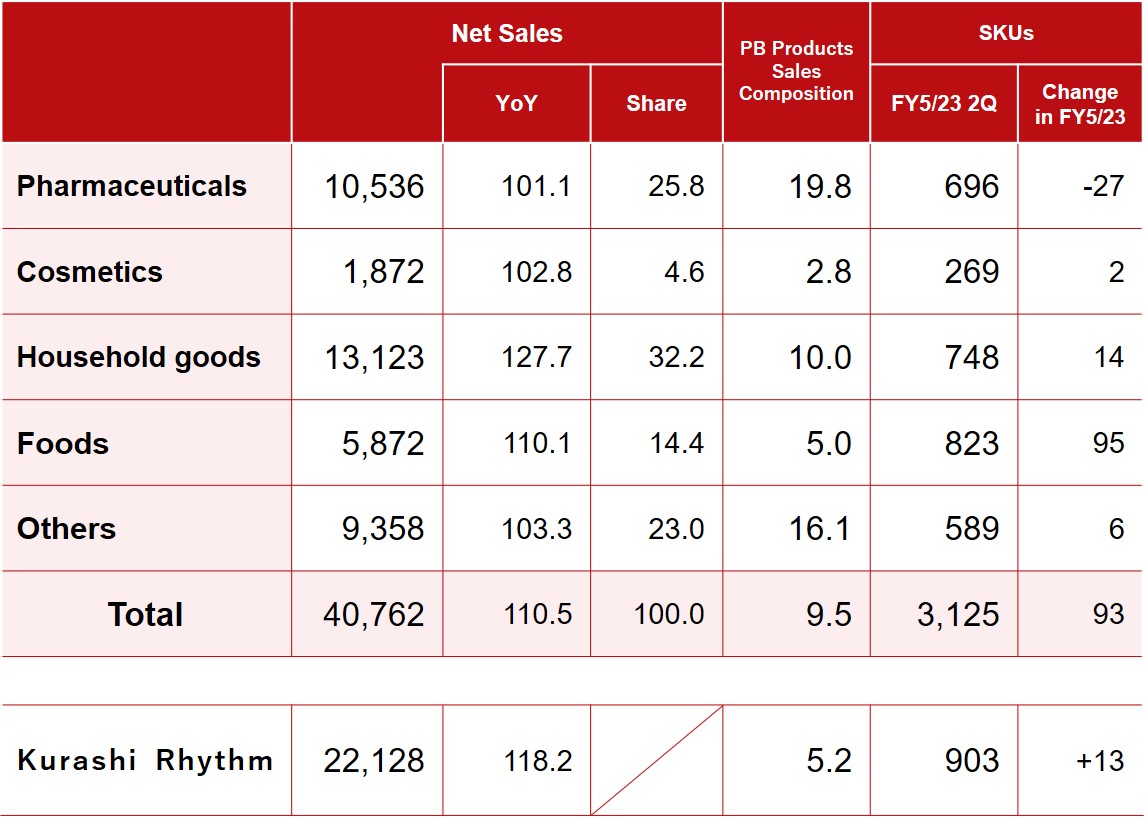

B & D = B & D Eleven = Drug Eleven TGMD = Tsuruha Group Merchandising