Index

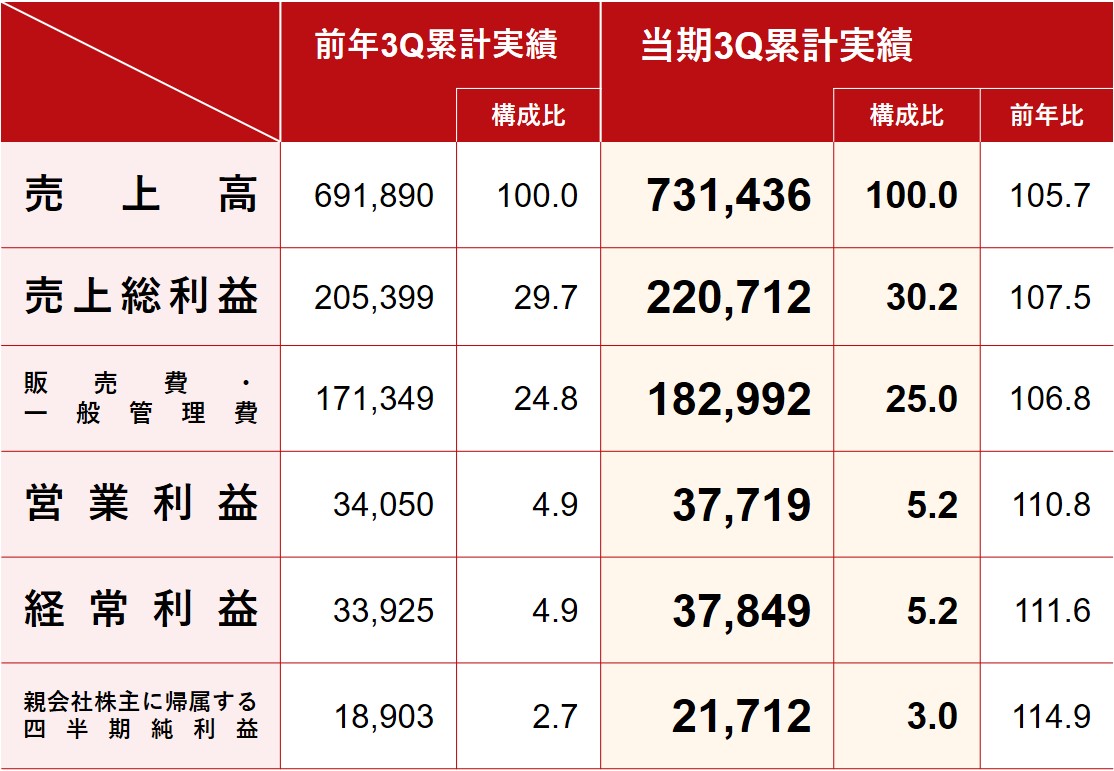

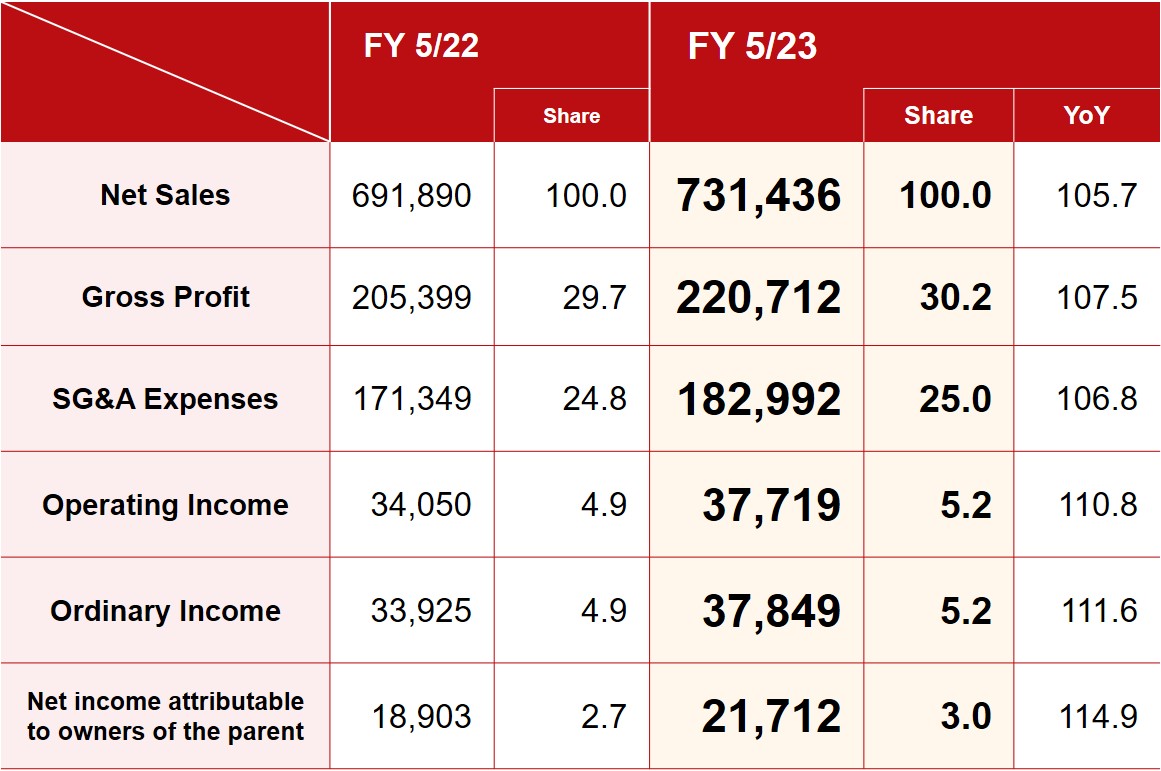

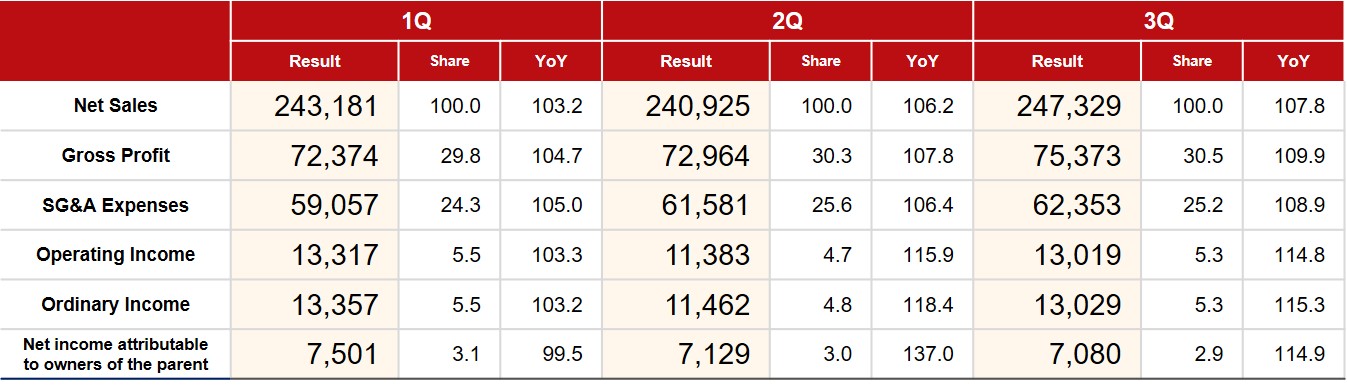

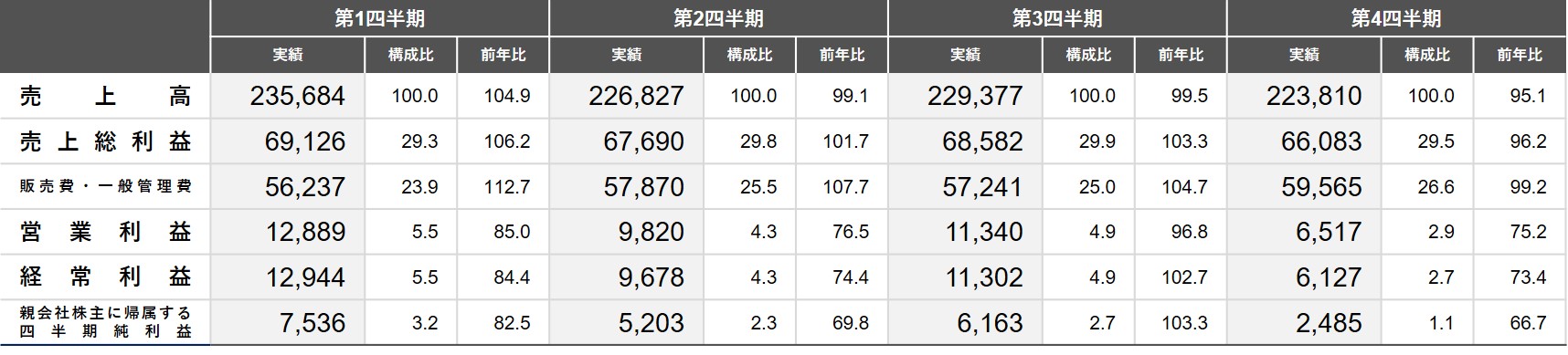

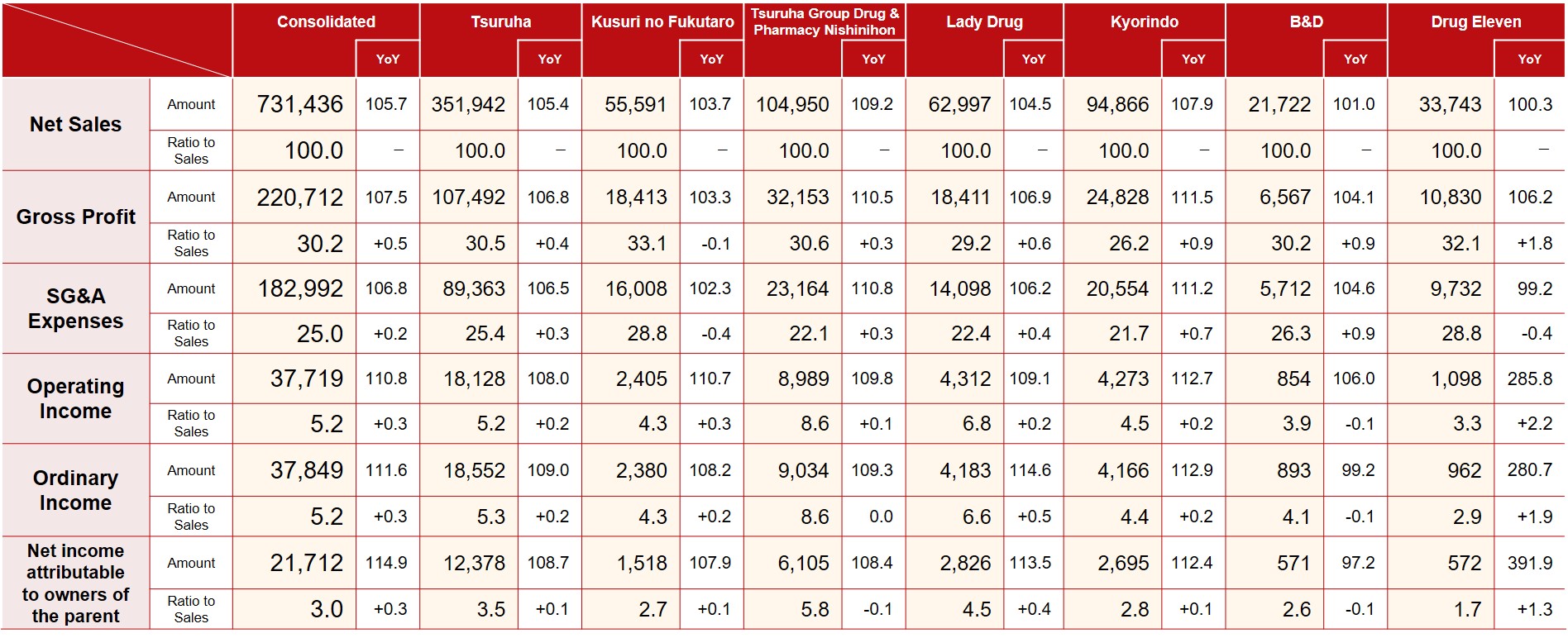

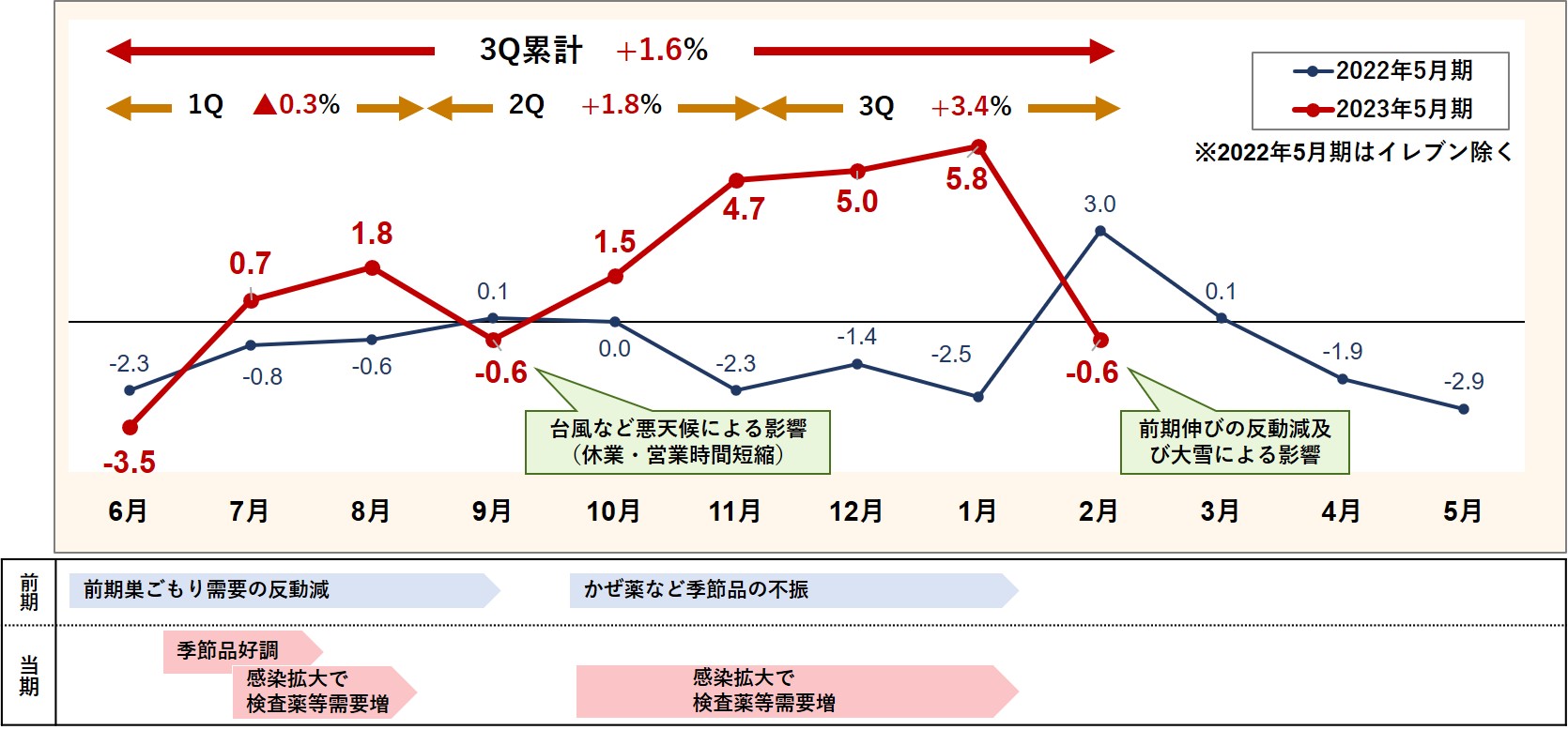

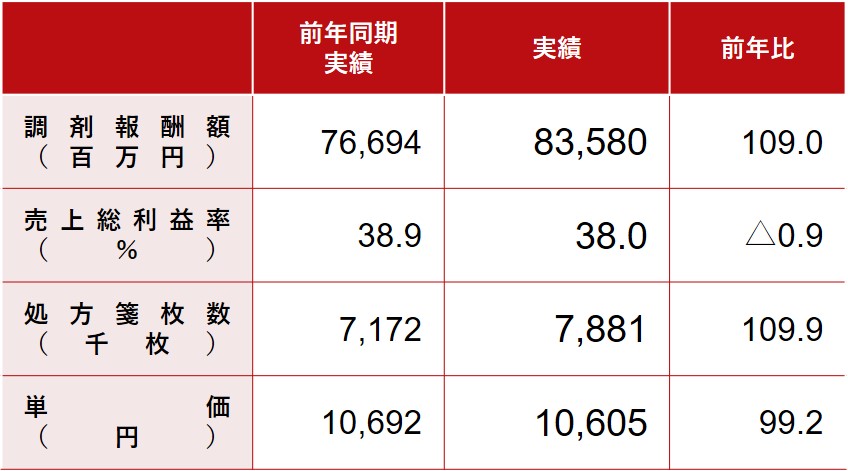

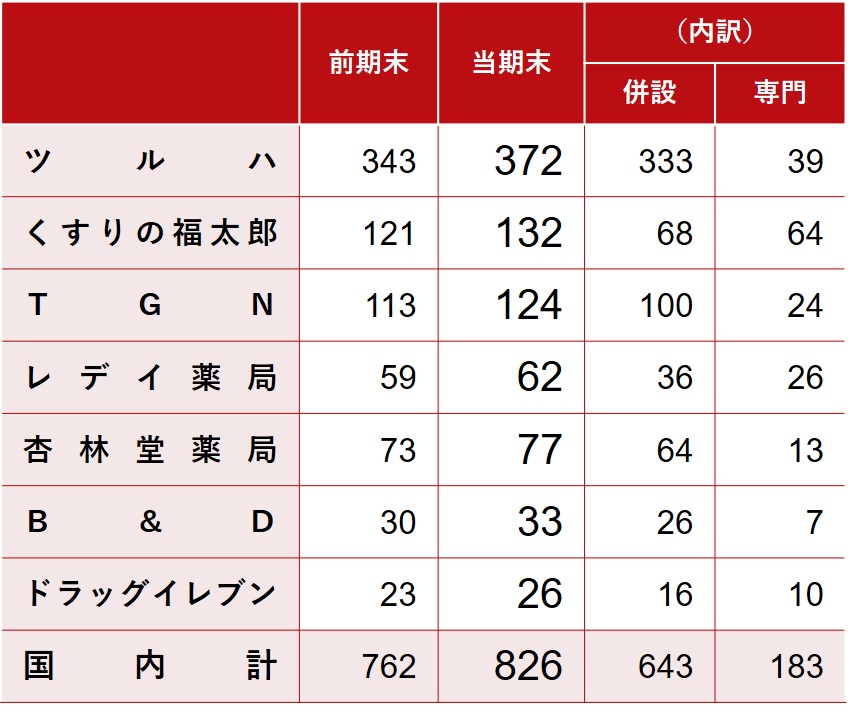

◼ FY05 / 2023 the 3rd quarter results overview ◼ Medium-term management plan and initiatives for the current fiscal year* The following abbreviations may be used in this document.

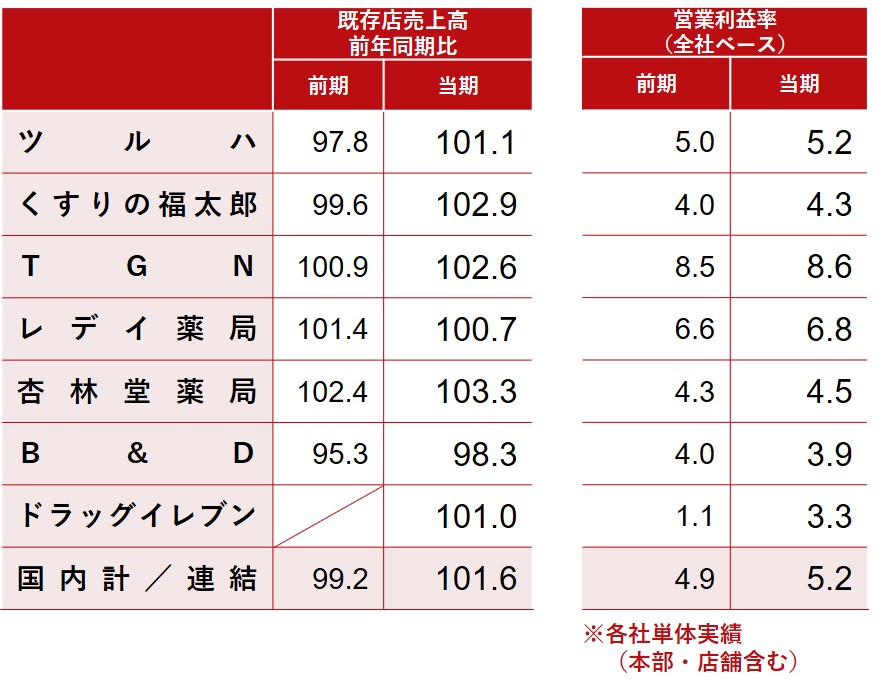

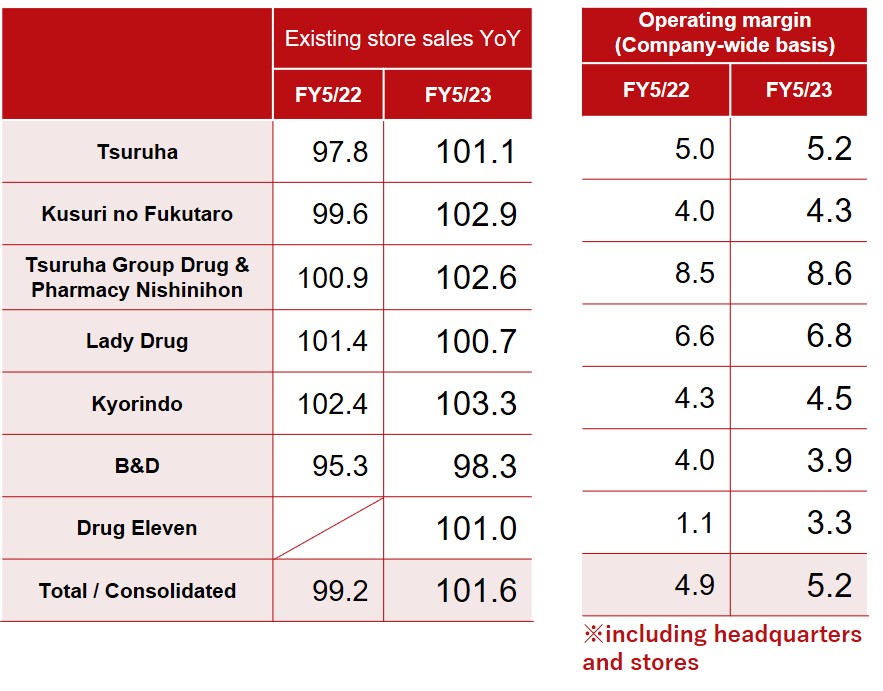

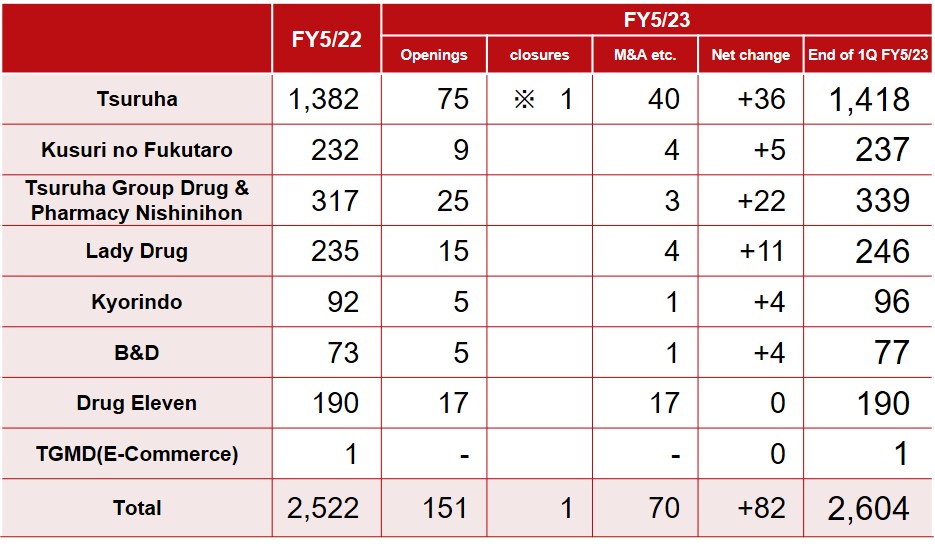

Fukutaro = Kusurino Fukutaro TGN = Tsuruha Group Drug & Pharmacy West Japan Lady = Lady Pharmacy

B & D = B & D Eleven = Drug Eleven TGMD = Tsuruha Group Merchandising