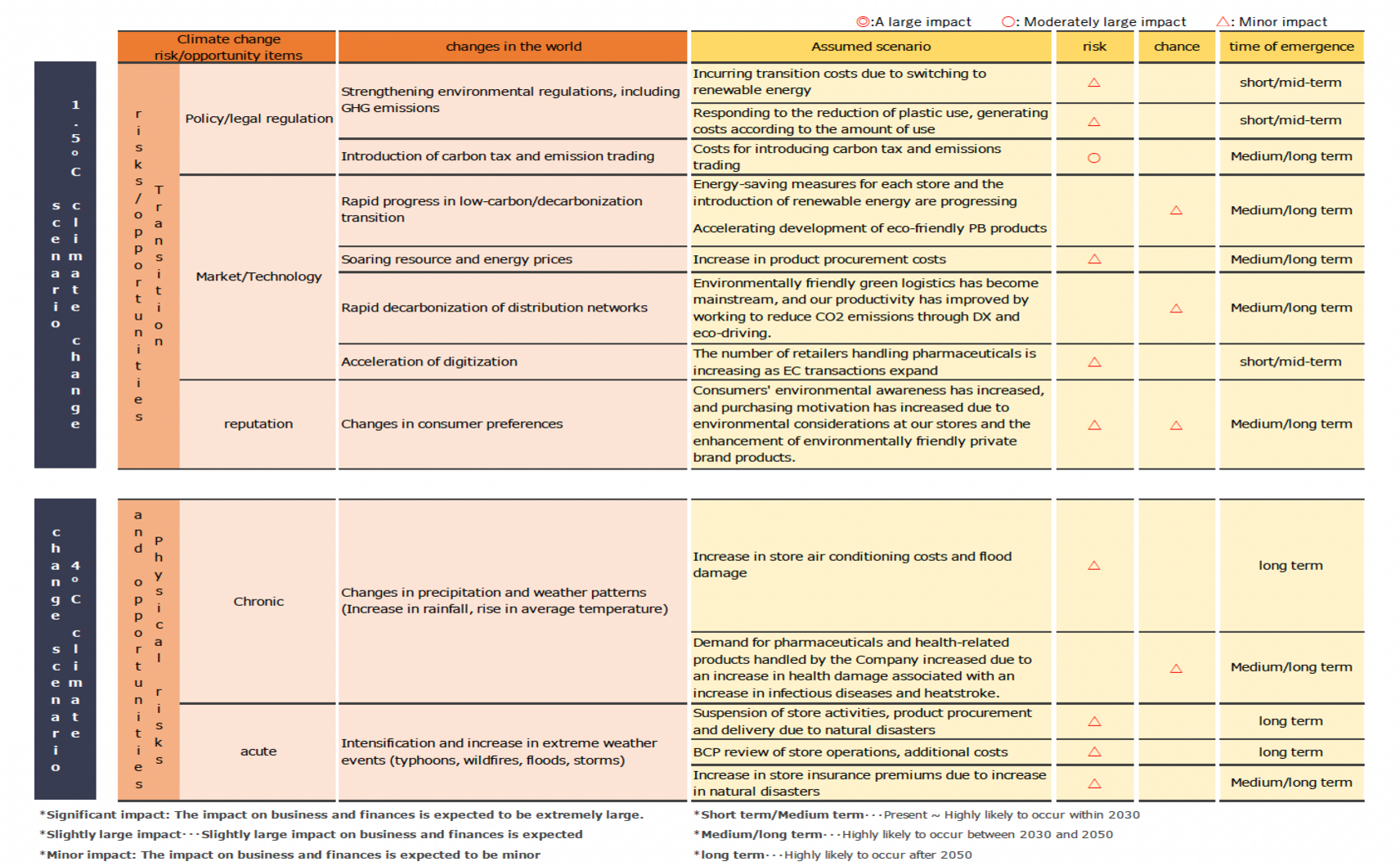

- As the effects of climate change become apparent in all parts of the globe, efforts aimed at realizing a carbon-free society are becoming more active worldwide. In 2015, the United Nations Framework Convention on Climate Change (COP21) adopted the new international framework "Paris Agreement" for reducing greenhouse gas emissions after 2020, and Japan has set a greenhouse gas reduction target. , We have set a goal of reducing greenhouse gas emissions by 46% from fiscal 2013 to fiscal 2030, and reducing greenhouse gas emissions to virtually zero by 2050.

- The impact of our business activities on climate change is thought to be largely due to the use of energy in stores. In addition to working on LED store lighting and the introduction of EMS for air conditioning, we have sold (*) the CO2 emissions reduced by these efforts through the J-credit system, etc. to reduce CO2 emissions for society as a whole. I am contributing.

- The Japan Chain Drugstore Association (JACDS), which is an industry group of drugstore companies to which our company belongs, established the SDGs Promotion Committee from FY2019, and as one of the basic themes of the business plan, "SDGs initiatives throughout the industry" To promote ". The Tsuruha Group supports this policy and will endeavor to promote SDGs throughout the industry by cooperating and cooperating with JACDS and its member companies.

(*) J-credit system: A system in which the national government certifies the amount of reduction and absorption of greenhouse gases such as CO2 as "credits" through efforts such as the introduction of energy-saving equipment and forest management. The generated credits are used for various purposes such as achieving the goals of the Low Carbon Society Action Plan and carbon offsetting. Since 2012, we have been conducting emission allowance transactions utilizing the "domestic credit system," which is the predecessor of this system.

Utilization of renewable energy

In 2021, we began introducing self-consumption solar power generation, which uses renewable energy to cover part of the electricity used in our stores. As of May 2023, it has been installed in 58 stores, contributing to the reduction of CO2 emissions associated with store operations.

Reduction of dispensing drug delivery

We are working with drug wholesalers to reduce the number of deliveries of ethical drugs at dispensing pharmacies, contributing to the reduction of CO2 emissions associated with transportation.

Purchased product receiving service on EC site

We provide a service that allows you to specify the Tsuruha Group stores as a place to receive products purchased from EC sites, etc., and contribute to the reduction of CO2 emissions associated with the delivery of courier services.

Response to natural disaster risk

With climate change, the risk of natural disasters such as heavy rains and floods may increase. The Tsuruha Group has concluded agreements with local governments regarding disaster support in order to support the lives of local residents through the supply of supplies even in the event of a disaster, and is also conducting fund-raising activities at stores as needed.