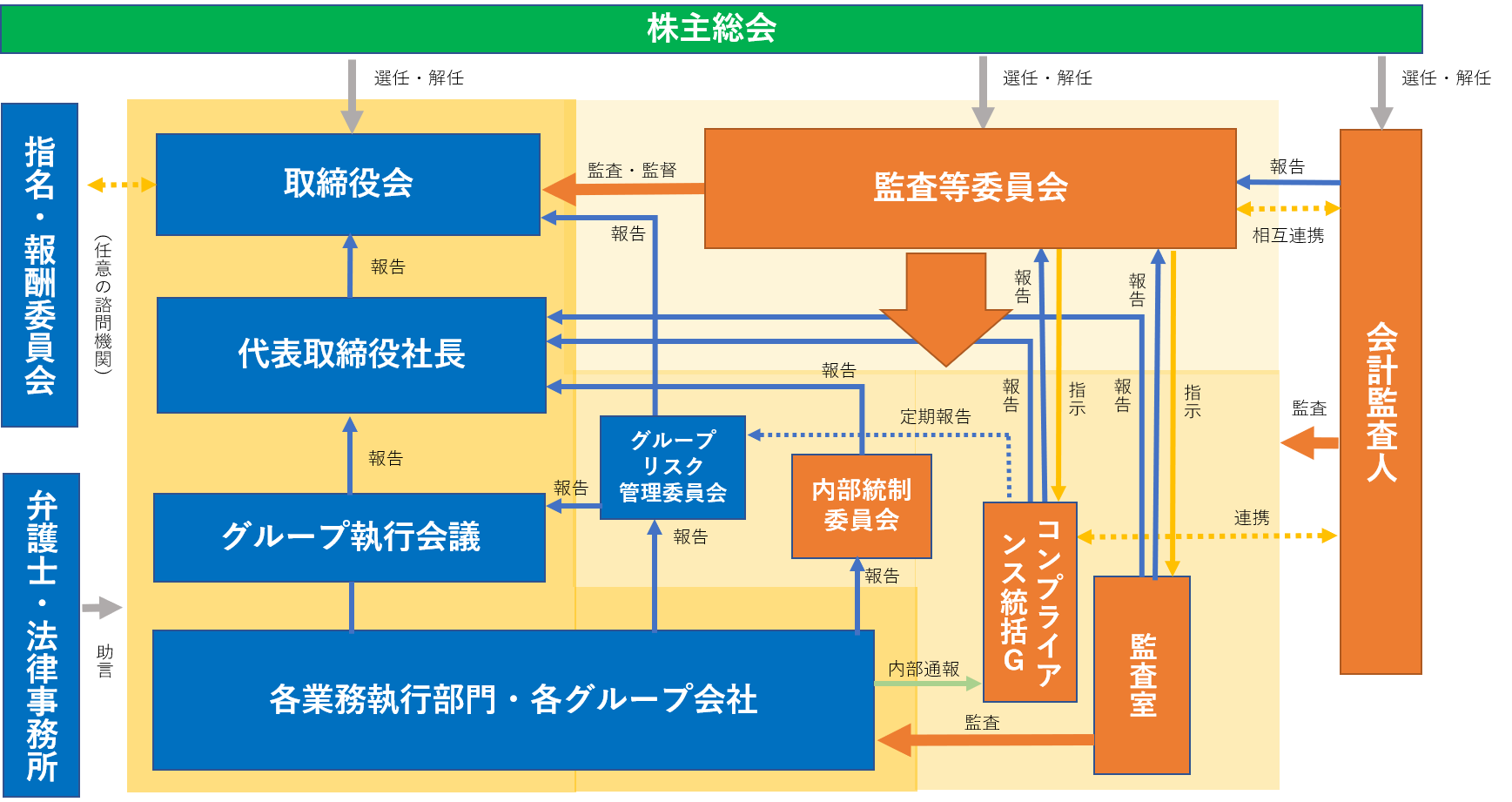

Governance system (overview of corporate governance system)

● Board of directors

The Board of Directors is comprised of 11 directors (including 5 outside directors), and is responsible for determining matters to be resolved by the Board of Directors as stipulated in laws and regulations, the Articles of Incorporation, and internal regulations, as well as supervising the status of the execution of duties. Regular Board of Directors meetings are held once a month, and extraordinary Board of Directors meetings are held as necessary.

In addition, the Company has introduced an executive officer system, separated the business execution function and business supervision function in corporate management, and clarified the functions and responsibilities of directors and executive officers to strengthen the governance function. In order to clarify the mission and responsibilities of the directors, the term of office of the directors is set to one year.

● Effectiveness evaluation

Based on the Corporate Governance Code, the Tsuruha Group believes that it is important to work to further improve the function and effectiveness of the Board of Directors, and regularly analyzes and evaluates the effectiveness of the Board of Directors. We are here.

In the evaluation, the Board of Directors and Auditors use the "Questionnaire on Evaluation of the Effectiveness of the Board of Directors" to conduct a self-evaluation of each evaluation item, and the Board of Directors deliberates on the analysis results of this questionnaire. We will evaluate based on that opinion. In addition, when implementing it, we have introduced a mechanism that involves an independent third party as much as possible, and in order to ensure objectivity, we have introduced procedures and analysis by corporate lawyers.

| Evaluation items in 2023 | Efforts to address issues from last year | Theme for future consideration |

|---|---|---|

|

Evaluation items for 2020 ① Structure of the board of directors ② Management of the board of directors ③ Board of directors agenda ④ System to support the board of directors |

Recognized issues and future measures

|

Theme for future consideration

|

● Nomination and Compensation Committee

In order to strengthen the independence, objectivity, and accountability of the Board of Directors' functions regarding the nomination and compensation of senior management and directors, the Company has established an independent Nomination and Compensation Committee as an advisory body under the Board of Directors. I am. The committee has a structure that allows it to be appropriately involved and provide advice when considering important matters such as nominations and compensation. The majority of the members of the Nomination and Compensation Committee are independent outside directors, and independence is maintained to ensure fairness and transparency.

● Officer compensation

Basic policy

The Company considers director remuneration to be an important incentive for realizing its management philosophy, and has adopted the following basic policy as a systematic design that considers each element.

- (1) To promote the corporate philosophy of "providing affluence and leeway in the lives of customers"

- (2) The amount level and design should support the participation and success of excellent management teams.

- (3) To raise awareness of our contribution to medium- to long-term growth.

- (4) It should be linked to the company's business performance and have a built-in mechanism to suppress the emphasis on short-term orientation.

- (5) From the perspective of accountability to stakeholders such as shareholders and employees, the design should be transparent, fair and rational, and should be decided through an appropriate process to ensure this.

Specifically, remuneration for directors consists of fixed remuneration, performance-linked bonuses, and transfer-restricted stock remuneration.

Regarding the remuneration level of directors, in order to respond swiftly to changes in the external environment and market environment, the same industry and scale (sales, market capitalization, etc.) are utilized by utilizing objective remuneration survey data of external organizations. (Selected based on consolidated operating income, etc.) We will verify each year with reference to the executive compensation levels of companies in other industries.

Details of remuneration for directors and composition ratio, etc.

Remuneration for directors

① "Fixed remuneration" (monetary remuneration) according to the position (position) as the basic remuneration

(2) "Bonus" (monetary compensation) based on business performance and individual evaluation for each business year

(3) “Stock compensation” (share compensation with transfer restrictions) is set according to the position (position), and the composition ratio is different between directors and outside directors who are audit and supervisory committee members whose responsibilities differ greatly, and other directors.

Regarding the remuneration composition of directors excluding directors who are Audit and Supervisory Committee members and outside directors, we will set the ratio of basic remuneration, bonuses and stock remuneration, conscious of functioning as an important incentive to realize the management policy.

Specifically, the basic remuneration: bonus: stock remuneration = 30% -40%: 50% -60%: 5% -15%.

In addition, "stock compensation" will be delivered to the Company's shares.

Overview of the remuneration structure of directors (excluding directors who are Audit and Supervisory Committee members and outside directors)

| Types of rewards | Payment standard | provision Method |

Reward Constitution |

|---|---|---|---|

| Basic reward | Payment standard Determined for each person based on the standard amount for each position | Payment method Monthly cash |

Reward composition 30% -40% |

| Bonus | Payment standard As a monetary remuneration that reflects the performance of a single year, the amount of payment for each individual is calculated after determining whether or not payment is made and the total amount in the case of payment based on the consolidated performance indicators of the previous year. | Payment method Once a year cash |

Reward composition 50% -60% |

| Stock compensation | Payment standard The number of shares to be granted to each director is determined based on the stock price and position standard, taking into consideration various matters such as the contribution and responsibilities of each allottee in the Company. | Payment method Once a year stock |

Reward composition 5% to 15% |

(Bonus)

Bonuses as performance-linked remuneration are monetary remuneration that reflects the performance of a single year. Based on the consolidated performance indicators of the previous year, the presence or absence of payment and the total amount of payment are determined, and the amount of payment for each individual is calculated. Indicators related to the calculation of bonuses are set based on the "operating income and net income" of consolidated business results and the degree of achievement of individual missions from the viewpoint of emphasizing the degree of achievement of profit growth. Payment will be made once a year after an internal approval procedure and after the end of the Ordinary General Meeting of Shareholders.

(Stock-based compensation) * Transfer-restricted stock-based compensation

The transfer-restricted share compensation is based on the stock price and the number of shares granted by each director based on the position standard, and the number of shares granted is determined by comprehensively considering various matters such as the responsibilities of each allottee at the Company. To decide.

The timing of the allotment will be decided at the Board of Directors meeting held in September after the end of the Ordinary General Meeting of Shareholders. The restricted shares to be allocated to the directors of the Company are pre-delivered.

Only basic remuneration is paid to directors who are Audit and Supervisory Committee members, external directors who are Audit and Supervisory Committee members, and outside directors, considering that they are independent of business execution.

Overview of remuneration composition for directors and outside directors who are Audit and Supervisory Committee members

| Types of rewards | Payment standard | provision Method |

Reward Constitution Board member who is an audit and supervisory committee member |

Reward Constitution Outside director |

|---|---|---|---|---|

| Basic reward | Payment standard Determined for each person based on the standard amount for each position | Payment method |